If it acts like a duck, quack likes a duck; it’s probably a duck…

“…the reality of it, the market today has a lot of scams and I think there’s a lot of securities laws that are being violated by the ICO phenomenon right now…” Peter Smith, Blockchain Co-Founder & CEO [1]

The lines between cryptocurrencies and securities continues to blur making it hard for governments, regulators and market participants to understand the functional differences between them and how they should be ultimately treated. Traditionally, a security was a physical document (nowadays electronic) that showed an individual’s ownership in a company’s stocks, bonds or other financial instruments. The characterization of a cryptocurrency is not as straightforward and that’s a result of the different use cases and motivations for companies issuing virtual coins or tokens. Unlike traditional IPO’s where investors receive shares that represent ownership in the underlying company, Initial Coin Offerings (ICO’s) involve the sale of virtual coins or tokens that are based on blockchain technology that are unique to the issuing company or its network. The virtual token represents some arbitrary value that’s based on the value of the company’s network or the investment value of that open protocol. [4] One thing is clear, in certain cases particularly around the use of ICO’s by companies to raise money, market participants are operating in a regulatory grey area.

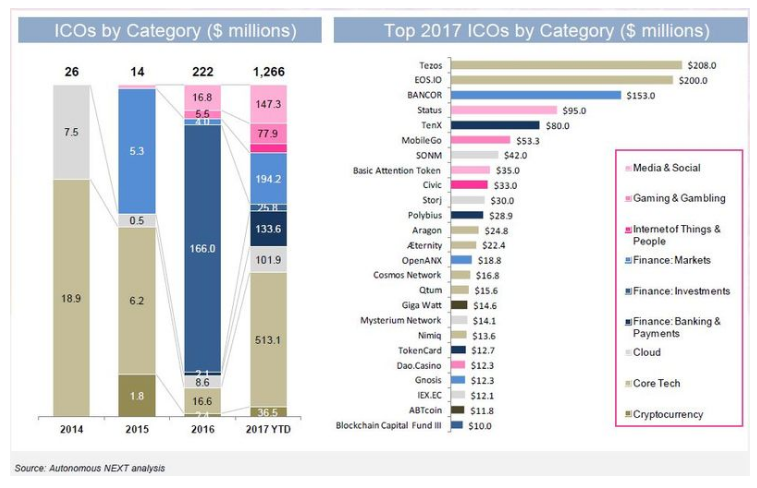

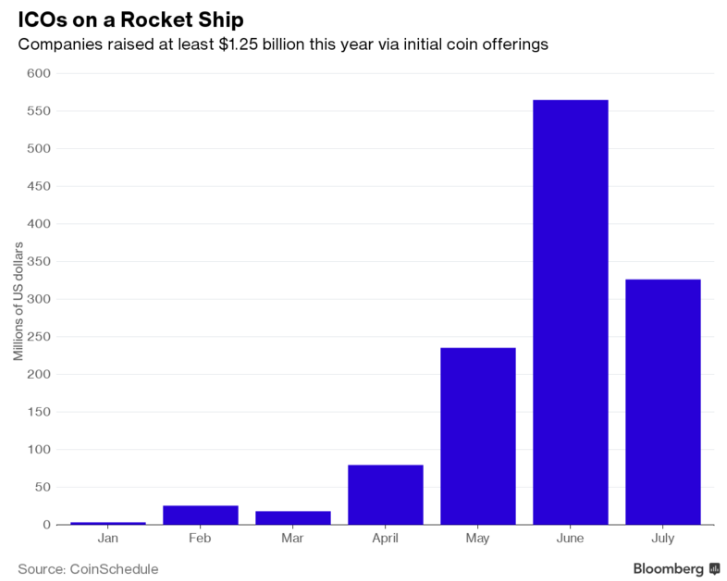

On July 15th 2017, Tezos (a smart contracts platform) raised ~232M through an ICO making it the largest sale to-date. To put that into context, the average IPO in Hong Kong this year was around $31M and the average IPO globally was around $91M. [2] The ICO market has arguably hit an inflection point with funding raised via ICO’s to-date (~1.25B) and the monthly run-rate (~601M) exceeding the monthly run-rate of funding raised via early stage venture capital (~550M) in June. [3] One of the main attractions for firms to raise money via the ICO market is because cryptocoins bypass traditional middle men such as banks and venture capital firms minimizing fees and offering faster access to capital. The drawback is that traditional checks and balances as well as consumer/investor protections are non-existent. Growth of money raised via ICO’s was ~1,585% in 2016 and is already up 570% YTD.

The recognition by governments and regulators of cryptocurrencies should not be seen in a negative light as this reinforces the reality that these technologies are moving into widespread adoption. Regulatory bodies like the SEC and the rules and regulations they enforce around disclosure requirements and consumer protections were created for a reason, let’s not forget that the functions of the capital markets once operated in a regulatory grey area. It’s unclear what happens to past ICO’s that have already taken place as the SEC has signaled they will likely be flexible with previous issuers. Going forwards, issuers, investors and people buying ICO’s will need to ensure that whatever they purchase will be compliant with US securities laws or risk potentially being liable for activities further down the road.

References

- https://www.bloomberg.com/news/videos/2017-05-31/looking-for-a-bubble-in-bitcoin-s-recent-bounce-video

- http://www.ey.com/Publication/vwLUAssets/ey-global-ipo-trends-q1-2017/$FILE/ey-global-ipo-trends-q1-2017.pdf

- https://medium.com/@wmougayar/has-ico-cryptocapital-exceeded-early-stage-venture-capital-funding-yes-b0500d5fbe8

- https://www.bloomberg.com/news/articles/2017-07-25/bankers-ditch-fat-salaries-to-chase-digital-currency-riches

- http://www.nasdaq.com/article/3-reasons-the-irs-bitcoin-ruling-is-good-for-bitcoin-cm339333

- https://www.bloomberg.com/news/articles/2017-07-26/what-s-next-for-crypto-coins-as-sec-tames-wild-west-of-finance

- https://www.bloomberg.com/news/articles/2017-07-26/what-s-next-for-crypto-coins-as-sec-tames-wild-west-of-finance

One comment on “If it acts like a duck, quack likes a duck; it’s probably a duck…”

Comments are closed.

Nice!

Interesting with a ca. 10% fall in price of bitcoin and other cryptos after the SEC’s decision. Might suggest the markets suspicion or disfavor of a regulatory strangle hold. I struggle to see however the widespread use of crypto currencies without the sensible oversight of a regulatory body. Furthermore, with large banks coming into the picture in an attempt to widen profits i can only imagine a paternalistic-regulatory order will be good for investors, and entrepreneurs alike.

Users who have LIKED this comment: