Blockchain – a New Game for Accounting and Auditing?

As described by Dr. Jeff Welser, “Blockchain is an emerging platform for transaction services that will fundamentally change the world of financial services.”

Accounting

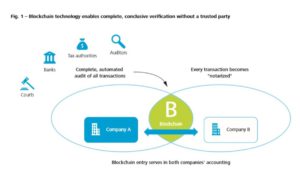

Blockchain acts as an indispensable ledger, a canonical source of truth. The current accounting practice is one where companies keep their financial records in private ledgers and rely on accountants to reconcile them against those kept by their third party counterparts. This tedious and labor-intensive work implies higher human resources cost, lower efficiency and stress workload especially in the month-ends. A real-time shared ledger, with tamper-proof feature and proper visibility setting, can help saving manpower and time. It can also minimize potential disputes. As such, Blockchain would be able to change the traditional methods of invoicing, documentation, contracts, and payment processing. Each accounting transaction on the Blockchain, including all relevant documents, is tracked. The entire paper trail across multiple departments or even companies can become more tractable.

Some other potential uses for Blockchain would be tracking ownership of any tangible and intangible assets, such as raw materials, intellectual property rights, and development of “smart contract.” Imagine an invoice is automatically paid after passing a system check that delivered goods have been received according to order and specifications and sufficient funds are available in the company’s bank account. Some of these tasks are manually performed as of now.

Auditing

With Blockchain, is there even a need for audits in the future?

Each year, companies are required to submit their audited reports for tax and regulatory compliance purposes. Each audit is a costly exercise, requiring long hours input from the company’s accountants. The audit process involves a lot of paper audit (e.g. orders, delivery notes, invoices, payment records), financial records maintained by the company and third party verification. The risk of unnoticed modification on paper receipts is comparatively lower than electronic record.

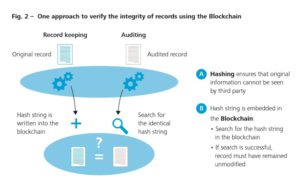

Using the Blockchain makes it possible to prove integrity of electronic files through the use of hash string, a digital fingerprint of sorts. The fingerprint is immutably timestamped by writing it into the Blockchain via a transaction. At a later time, one can prove the integrity of a file by re-generating the same fingerprint and comparing it with the fingerprint stored in the Blockchain. If the fingerprint is identical, it means the document has remained unaltered and untampered since its first submission. At the same time, standardization of book record would allow auditors to verify a large portion of important data behind the financial statements automatically. The cost and time necessary to conduct an audit would decline considerably.

Source: Blockchain Technology A game-changer in accounting? (author: Deloitte & Touche GmbH Wirtschaftsprüfungsgesellschaft)

The use of the Blockchain for accounting and auditing is promising, although a long way to go. From simplifying compliance with regulatory requirements to enhancing the double-entry bookkeeping, anything looks ripe for disruption. At the end of the road, fully automated audits may become a reality.

In future, audit firms may move away from traditional compliance activities and towards strategic advisory roles focused on helping their clients make better business decision, improve financial situation, or evolve with technology. Deloitte, for example, in January 2017 opened a new blockchain lab in Dublin, Ireland, which by the end of 2017 will become a home to 50 developers and designers who will dedicate full time on the technology. KPMG and Microsoft revealed that they were partnering on a series of innovation workshops focused on the development of the blockchain technology.

________________________________________________________________________________

[1] https://hbr.org/ideacast/2017/06/blockchain-what-you-need-to-know

[2] https://hbr.org/2017/01/the-truth-about-blockchain

[3] http://www.accaglobal.com/us/en/member/member/accounting-business/2017/04/insights/blockchain-17.html

[4] https://www2.deloitte.com/content/dam/Deloitte/de/Documents/Innovation/Blockchain_A%20game-changer%20in%20accounting.pdf

[5] http://www.ey.com/gl/en/services/assurance/ey-reporting-building-blocks-of-the-future

[6] https://www.accountingtoday.com/opinion/blockchain-accounting-and-audit-what-accountants-need-to-know

Users who have LIKED this post:

2 comments on “Blockchain – a New Game for Accounting and Auditing?”

Comments are closed.

Hi Pat. I read your article and linked Deloitte document with interest. I agree that blockchain will decrease the cost and time necessary to conduct audit. Blockchain will guarantee the correctness of accounting to some extent, however, i think the necessity of accountants will not be impaired essentially.

I studied window dressing settlement, or fraudulent accounts when I belonged to Credit Division of a bank. Common methods are fictitious sales, fictitious inventory and to avoid depletion of goodwill. Fictitious sales will be no longer useful because gross sales will be booked in a shared ledger as aggregated costs of other companies. On the other hand, it will be still a duty of an accountant to confirm whether inventory and goodwill have values as shown on the ledger. Blockchain may help, but there will be many things left for accountants.

BTW, if investors and banks can see the ledger on a real-time basis, this must lead to many business ideas and startups.

Hi Kenta, thank you for the comments and elaboration. Yes, the accountants role will not be impaired, but rather focused on value addition. With the help of Blockchain technology, the in-house accountants can spend less time on routine reconciliation and allocate more time in planning, performing financial analysis and providing insights/advice to management.

At the same time, auditors spend less time in identifying fictitious transactions. They can spend more time on complex transactions, analytical review, valuation (inventory, asset, goodwill, derivatives etc) and overall compliance. Fully automated audit yet need to be reviewed by the Professionals still. By saving time in compliance activities, the accountants can be freed up for providing value-added services.

I would imagine the visibility of the shared ledger may be restricted (private / consortium blockchain) to entities involved, company may still prefer presenting their performance holistically on an aggregate level. Yet, anything is possible. Perhaps, a question needs to be addressed first – how would the government regulatory bodies like to shape the financial sector and regulation in the future?