How Profitable Is The Venture Capital Business ?

The landscape of venture capital (VC) has significantly evolved over the past years, and the industry is in great shape. VCs have raised a tremendous amount of capital ready to be invested, startups are disrupting industries through cutting edge technologies, and the tech’ IPO market is improving. Carl Eschenbach, partner at Sequoia Capital, was quite optimistic about the future of venture capital while answering a few questions on the industry last week.

In fact, Sequoia Capital is one of the top VC firms in the world with more than $7.6 billion raised, and a portfolio of more than 1,400 startups including Apple, Youtube, Stripe, Airbnb and Whatsapp. In the last 30 days, they invested in 14 startups with amounts ranging from a few million to a hundred million dollars like in Mobike – quite an impressive pace for a VC. On the other side, we haven’t heard a lot about failed million dollar investments like Joost, eToys, PepperTap, DashNavigation or AdBrite.

The traditional business model of a VC firm is quite simple. You raise a fund from limited partners (LPs): most commonly banks, pension funds, or foundations, and invest in high growth potential companies hoping to get an exit. You charge an annual management fee, around 2% of the total fund, and you get 20% of the earning if a company within your portfolio has an exit.

According to PitchBook, there are 798 VC firms actively investing in the U.S. If you look at it from an entrepreneurial perspective, it’s a very saturated market – and like any market, there are a few winners and tons of losers. Sequoia Capital is among the few big winners with Andreessen Horowitz, Google Ventures or First Round Capital. Venture capital is one of the riskiest investment strategies as Fred Wilson explained: « I’ve said many times on this blog that our target batting average is “1/3, 1/3, 1/3”. We expect to lose our entire investment on 1/3 of our investments, we expect to get our money back (or maybe make a small return) on 1/3 of our investments, and we expect to generate the bulk of our returns on 1/3 of our investments. » According to Seth Levine, the industry standard regarding VC outcomes is a 3x return, enough to beat the public markets.

Let’s take for example a $100M fund, you have desired returns of $300M and decide to invest $10M in 10 different startups. An optimistic scenario according to Levine would be that within your 10 deals, 1 is a unicorn, 1 has a medium exit (around $200M), 2 have small exits (around $6 to $10M), and 6 are losers (0$). But even with those numbers, you just reached the desired return rate of the industry, and there are small chances of actually getting a unicorn out of 10 deals.

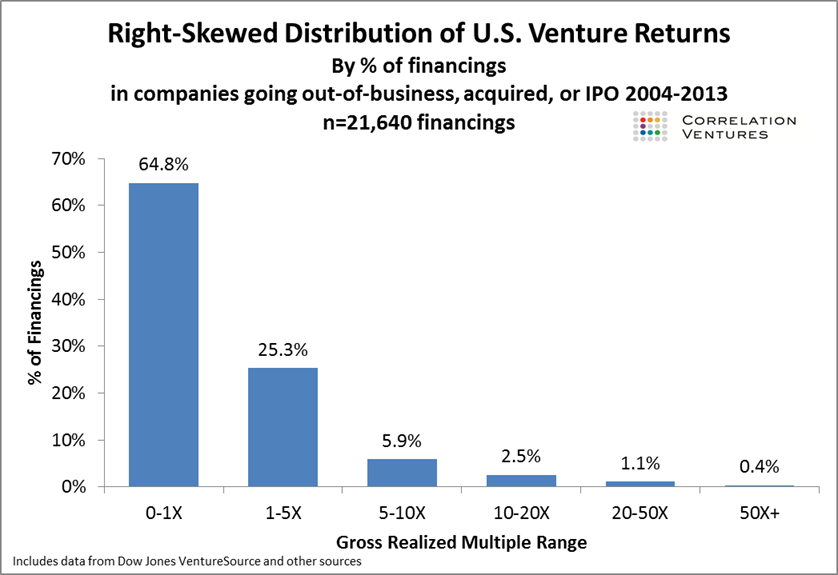

As Correlation Ventures shows in the following graph, 65% of venture-backed startups fail to return 1x capital, and only 4% produce a return of 10x or more. So considering the industry standards, there’s almost 90% of the investment deals that are somewhere between breaking even and downright losing money.

So the VC business is a very challenging one, and most of them hardly reach profitability. A report from The Kauffman Foundation revealed that 62% of venture funds failed to exceed returns from the stock markets. That explains why the number of VC funds has shrunk by 30% in the past decade, according to National Venture Capital Association. A few industry insiders even speculated that the VC model is broken, especially the LP investment model and needs disruption. As the ex-general partner of 500 Startups, Dave McClure highlighted « most early-stage VCs fail to invest in enough companies » which makes it difficult to beat the odds and diversify your portfolio. « With this, expect new investment approaches to drive change and innovation in the VC industry over the next several years as all facets of Finance are moving online, including Venture Capital.»

References :

http://www.sethlevine.com/archives/2014/08/venture-outcomes-are-even-more-skewed-than-you-think.html

https://www.cbinsights.com/blog/biggest-startup-failures/

https://techcrunch.com/2017/06/01/the-meeting-that-showed-me-the-truth-about-vcs/

https://medium.com/correlation-ventures

Users who have LIKED this post:

10 comments on “How Profitable Is The Venture Capital Business ?”

Comments are closed.

This was an interesting introductory summary to venture capital returns. I believe its also crucial to mention that venture capital is a tiny asset compared to the overall investment sector. In 2016, VC firms managed a total of $165 billion in funds (http://nvca.org/pressreleases/2016-nvca-yearbook-captures-busy-year-for-venture-capital-activity/). Comparatively, the US Public Market Cap is over $25 trillion. VC accounts for less than 0.2% of US GDP. Despite venture capitals minuscule share of national investments, they generate annual revenue equal to approximately 20% of US GDP. Almost all of US’s top public tech companies have at some point received venture backing. Sequoia has had great success identifying those phenomally successful companies and capitalizing on it. The combined public market value of companies Sequoia has invested in equals approximately 22% of Nasdaq. That is quite an incredible feat for a single investment firm.

Users who have LIKED this comment:

Venture capital business differs a lot in different countries, and even between the west and the east coast. For example, west coast VC firms tend to give out much cleaner and less complex term sheets than east coast VCs, which are known to have much more complex term sheets that could make the deal negotiation process more lengthy and complex.

What distinguishes top tier and lower tier VCs is also the way they source deals. Normally well connected venture capitalists form a small circle of other VCs in their network to recommend deals to each other, so that they can lead and follow on investments on the same high quality deals. Less well-connected VCs, however, need to do more publicity for their firms, either through press or through campus events, and they would spend time evaluating all the pitches coming in their inbox. Sequoia, for example, almost never invests in companies that just show up at their door. They prefer deals recommended by their most trusted contacts within the industry.

Users who have LIKED this comment:

Thanks for the interesting post, Loic! I did not realize the “1/3, 1/3, 1/3” target…it’s definitely a lot lower than I would have expected, especially for distinguished firms like Sequoia. In the Harvard Business Review’s March 2013 issue, Dianne Mulcahy discusses six major myths about Venture Capital. They are:

1. Venture Capital Is the Primary Source of Start-Up Funding

2. VCs Take a Big Risk When They Invest in Your Start-Up

3. Most VCs Offer Great Advice and Mentoring

4. VCs Generate Spectacular Returns

5. In VC, Bigger Is Better

6. VCs Are Innovators

Dianne’s rebuttal to the common myth that VCs generate spectacular returns reads similarly to the argument that you presented in your blog post. According to a Kauffman Foundation report that she cites, out of nearly 100 VC funds studied over a 20 year period, only 20 of them outperformed the market by a 3-5% average over the same timespan. More astoundingly, 62% of the VCs they studied “failed to beat the returns available from a small-cap public index.” She argues that while venture capital is assumed to be a high-risk, high-reward activity, the data actually does not support the claim. Per the Kauffman Foundation report, although VC funds and their partners collect a significant sum of money from the fees they charge, rarely do they actually reap “the reward of high returns.”

Users who have LIKED this comment:

Thanks for the great post.

I agree that “the LP investment model and needs disruption” and it is becoming far riskier for GP (i.e. General Partner or initial investor) because IT market itself is dominated by big players such as Amazon and Google. Many conglomerates are now forming CVC (i.e. corporate venture capital) to not only aim for capital gain, but also to attain benefit through synergy, by linking investment portfolio to the investing company’s current operational capabilities. Furthermore, CVC could be as a strategy to eliminate potential competitors by acquiring the company. Also, as for startups, the credibility you’ll get through investors may help your business accelerate. However, there are a lot of cases in which CVC fails. Mainly because of the cultural differences between investors and startups. Startups tend to have fast-paced decision-making processes that enable rapid prototype testing. On the other hand for conglomerates, decision-making process is strictly in a hierarchy and it takes days and even months to get approval. Also, their different mindset causes a problem. A conglomerate tends to use CAUSAL THINKING –striving toward a known goal, analyzing, planning, organizing, whereas entrepreneurs tend to use EFFECTUAL THINKING –allowing goals to emerge, experimenting, remaining flexible. So, if CVC can find a way to reduce those cultural and differences, it would be better for a conglomerate to stop investing on tradition VC model and focusing on CVC model.

Users who have LIKED this comment:

Inciteful post! As a finance student a potential reason we may see this is that while LP’s make the mean-variance tradeoff (weigh the utility of extra risk with extra returns), studies show they also have some appetite for skewed returns. So they may be willing to to actually accept lower returns for higher risk when there is a potential for a huge gain. Much like investing your pocket money in a lottery!

Great post thanks again Loic

Users who have LIKED this comment:

Yes, totally agree!

Also, this industry is very volatile, because of its high-rsikness. When the market liquidity is great, the VC industry would expand tremendously; on the other hand, it shrinks as the market shrinks. Before the bubble in 1999, the market size of the VC industry is 100 billion, however during the 2005, there was only 20 billion. It is a higher risk investment for people who want to put a relatively small proportion of their money into a lottery.

Thanks Loic for the enlightening post. I see your point but maybe the flaws in the VC system are also caused by the behavior of the start ups.

“Some unicorns have made such generous promises to their preferred shareholders that their common shares are nearly worthless.” states Stanford Graduate School of Business Professor Ilya Strebulaev.

The United States is home to more than 100 of these so called unicorns (even this name shows how some of these ventures see themselves: too good to be true). These venture-backed companies are worth more than $1 billion each.

New research from Professor Ilya Strebulaev shows that these companies report values on average about 51% above what they are really worth. And some, including solar company SolarCity and financial technology company Kabbage, are more than 100% above fair market value. If the real fair market value would be valued more within the unicorn community maybe the hole VC investment system would show better results than the ones shown in the article above.

Hi Loic,

Thanks for the post. It’s interesting that there are so many VC firms in the US (I think you mentioned 798). What I think would be interesting to know to provide a bit of context is:

1) The average and median size of AUM of each firm

2) The average and median returns of each firm

3) The risk adjusted returns of each firm

In addition to this, a second question that comes to mind is…do you see the 2%/20% fee model coming under pressure? In the hedge fund industry what we’ve seen is that fees across the board have come under pressure due to poor returns compared to passive investments like ETF’s. Do you see something similar happening to VC firms?

It’s interesting how firms like Andreesen Horrowitz and Sequoia have been able to be successful for so long. Do you have any opinions on why that’s the case? Brand? Mentorship? Connections? Expertise? Personally I think it’s a combination of all of those things. I agree that there may be a bit of a slowdown in VC formation as its getting increasingly difficult for firms to differentiate themselves from each other. In my point of view, eventually the VC industry will start to look more like other industries where you have large corporate backed VC arms (Google Ventures etc.), historic and well established VC funds (Sequoia etc.) and then a scattershot of smaller regional VC firms.

Hi Loic,

That was a really insightful walkthrough about how the VC world really looks like apart all of its glamour and successful fundings. Although, I do wonder how the VC’s Limited Partners (LP) manage to put their own money into the business and do their day to day decisions without any biased or mislead thinking. Probably companies like Sequoia, Google Ventures and First Round Capital have good processes to avoid that.

Great post by the way!

Arthur Aita.

Thank you for this great post which provided me with concrete knowledge about venture capital business! Coming back to what Andrea Wang said, I think it is interesting to analyze the differences between different countries, steming from the different cultures around the world. I will consider the differences between Europe and United States.

The “risk culture” is less observable in Europe as in the United States, even at an individual level: people invest less in shares in Europe but do prefer bonds. It also leads to differences in venture capital business. The amount of investments in the United States is twice the european one ! This difference also leads to different investment strategies. While european venture capitals tend to invest more in the first VC round and in the later stage (when the company is already quite successful), american VC prefer investing in second VC rounds. Here is an article detailing the investment rounds: http://fundersandfounders.com/how-funding-works-splitting-equity/