The Evolution of Banking: AI

What is AI?

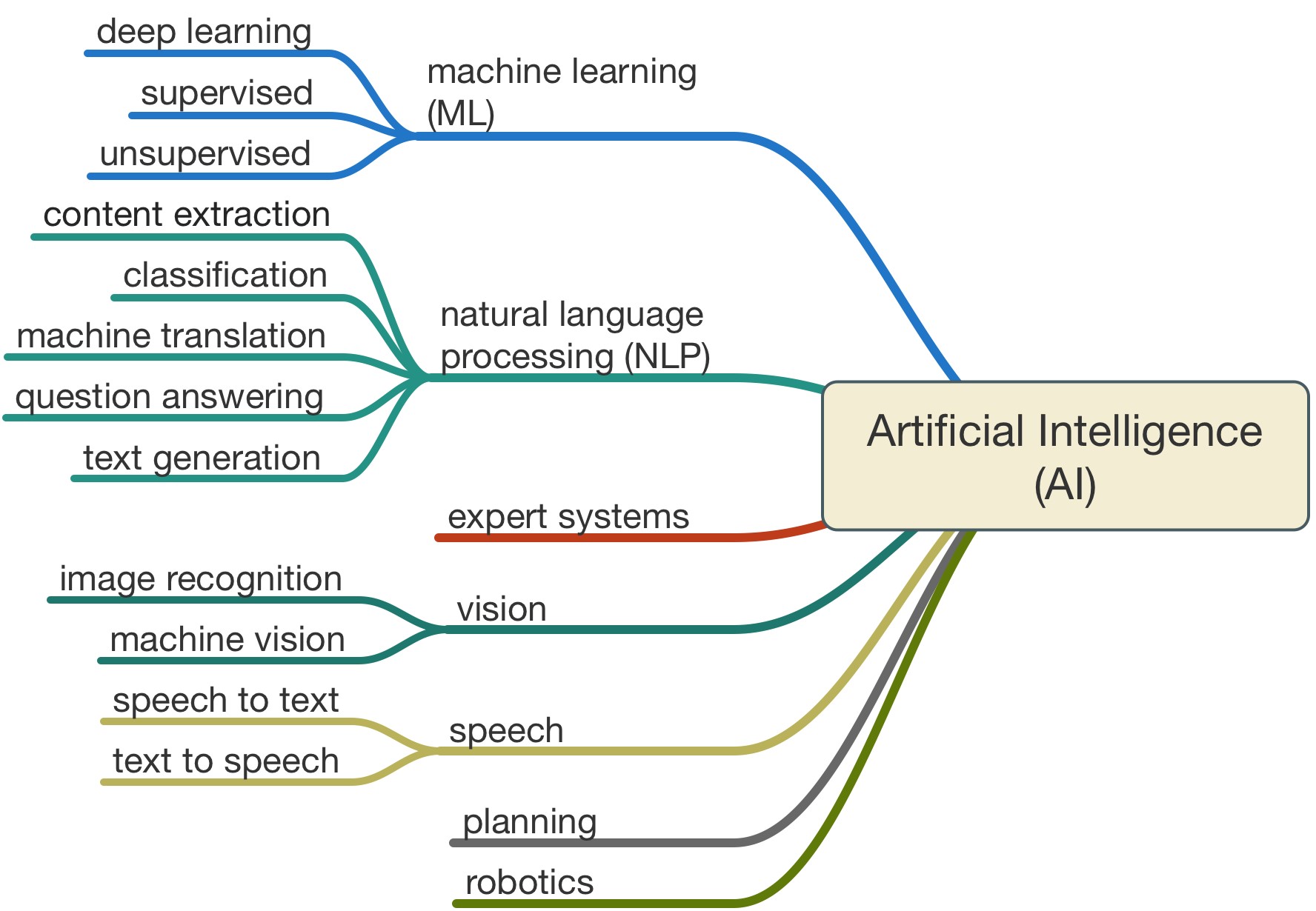

The concept of Artificial Intelligence (AI) was first coined in 1955, by Stanford Professor John McCarthy, as ‘the science and engineering of making intelligent machines’ [1]. In other words, it is a branch of Computer Science, in which a machine mimics the cognitive functions that are associated with the human mind – such as learning and problem solving. Some famous examples include high-level strategic gameplay (e.g. when Google’s DeepMind beat the world’s best Go player [2]) and autonomous cars. For machines to act and react like humans, they need access to sufficient information from the real world. To be able to initiate common sense, reasoning and problem-solving power, AI needs knowledge engineering – which provides data about objects, categories, properties etc. [3]. The graph below shows the different branches of AI [1].

Exploring Machine Learning

Following on from this is another buzzword: Machine Learning (ML). This is an application of AI, based around the idea that we should let machines learn for themselves. With the rise of the internet, there is a lot of digital information being created – which means there is more data available for machines to analyse and ‘learn’ from [4]. For this to be successful, humans need to hand-engineer features for the machine to look for. Delving deeper into ML, deep learning (DL) is all about reducing the human engineering aspect. One of the most common approaches to this is artificial neural networks, which is a mathematical system based on how neurons work in the human brain. DL focuses on making the machine classify information in the same method as the human brain. By working on a system of probability, the machine makes decisions, statements and/or predictions with a specific level of certainty. This is entwined with a feedback loop system, which regularly tells the machine if a decision made was right or wrong [5].

Banking Implementation

According to a report from the consultancy Accenture, Artificial intelligence will be the main way that banks interact with their customers within the next three years [6]. There is a big misunderstanding that AI will automate the banking process, and result in a less personalised experience for the customers. In fact, the opposite is true. AI will allow banks to better understand their customers, and analyse far deeper than a human would.

J.P. Morgan Chase recently introduced a Contract Intelligence (COiN) platform, designed to analyse legal documents and extract the important points/clauses. One example of how they used this was for the review of 12,000 credit agreements. This would normally take around 360,000 human working hours, but the AI platform finished the job in a matter of seconds [7].

In 2016, Bank of America launched an intelligent virtual assistant called Erica. This chatbot aims to use predictive analytics and cognitive messaging, to provide customers with personalised financial guidance – to reach their financial goals. The assistant would also be able to perform day-to-day transactions and be available out of banking hours, 24/7 [7].

CitiBank’s investment and acquisitions division, Citi Ventures, invested into Feedzai – a data science firm that can identify and eradicate fraud in real time. By conducting large-scale analysis, and detecting any questionable customer actions, it can monitor potential threats at greater accuracy and speed than humans can [7].

BNY Mellon is using AI at a high level, to reduce costs and eliminate any tasks of repetitive nature. Over the last 2 years, they rolled out over 220 bots (created by Blue Prism) to process automated tasks. This includes account closure, trade entry, transferring funds, responding to data requests from external auditors, correcting data mistakes/formatting and much more [7].

The Future of Banking

A 2017 report on banking trends highlighted enhanced customer personalisation as the number one trend [8]. With AI, algorithms can offer portfolio management advice, that is regularly updated based on the customer’s data. It will also allow banks to offer targeted offers and better market specific, relevant products. For investment houses (hedge funds, prop trading etc.), algorithmic trading can be enhanced by using AI to analyse the market sentiment. In fact, some reports claim that over 70% of trading activity today is undertaken by AI systems [9].

There are also productivity gains to be made, since repetitive and back office processes can be automated. Especially with the financial services industry facing stricter and stricter compliance requirements, AI can be used to evolve and work around new regulations. For instance, AI can be very useful in AML (Anti-Money Laundering) pattern detection – by moving away from rule-based software to a less rigid search list.

The machines won’t take over – yet. AI will gradually replace humans in many fields, but the risks of bias, privacy, trust etc. will create many obstacles along the way. With many banks facing falling profit margins, increasing customer expectations, and increasing competition from FinTech start-up’s – they need to reduce costs and improve their offering. It will be interesting to see how the face of banking will change over the coming years, especially with many tech firms (Apple, Facebook, Google etc.) heavily investing into AI and financial services.

References

[1] http://legalexecutiveinstitute.com/artificial-intelligence-in-law-the-state-of-play-2016-part-1/

[3] https://www.techopedia.com/definition/190/artificial-intelligence-ai

[5] https://www.cnbc.com/2017/06/17/what-is-artificial-intelligence.html

[6] http://www.bbc.com/news/technology-39419727

[7] https://www.techemergence.com/ai-in-banking-analysis/

[8] https://thefinancialbrand.com/63322/artificial-intelligence-ai-banking-big-data-analytics/

Users who have LIKED this post:

8 comments on “The Evolution of Banking: AI”

Comments are closed.

This is a great article, Jaykishen! It is interesting to hear a discussion around how AI could be used to improve customer experience. For me and exciting area of development is around mobile banking. To be able to ask a chatbot in the app if you can afford a new pair of trainers (for example) that cost $100, and for the bot to be able to state that because you have $200 in your account so yes you can is one thing. Another thing altogether is the possibility that the bot analyses your weekly/monthly spending, evaluates how long until your next payday, and then tells you whether you can really afford it! It could even link to pinterest and tell you that if you buy these trainers then you won’t be able to afford the bag you have pinned! It is certainly an exciting area.

Users who have LIKED this comment:

Great post! I’m particularly interested to see how AI + Blockchain will revolutionize banking. On one hand AI holds great promise as you summarize, and Blockchain will make the transactional nature of banking workloads more efficient and traceable.

Thanks for the post Jaykishen! Banking hasn’t changed for decades and the emergence of those technologies can finally drive the industry to be more efficient (360,000 hours of legal work and proof reading…).

What about the increased competition for financial services coming from FinTech startups? Do you believe that banks should adapt to them and focus more on a model of Bank as a Platform (BaaP)?

Hey Jaykishen,

Great blog on the future of banking and how AI will affect it. As Gaurav made a comment on Blockchain, it will be interesting to see how it affects the banking industry an if it completely eradicated banks as an intermediate and all transactions are transparent and virtual. Although Chatbots and conversational interfaces are emerging as trends in the banking world. AI is starting to become more of an augmenting force rather than a replacement when it comes to human jobs. It will be very useful in business intelligence and cyber security of banks and businesses.

references :

https://www.techemergence.com/ai-in-banking-analysis/

This article also relates to the big legacy challenges that traditional banks are facing. Banks that have been established in the 1980’s or earlier find it more and more difficult to compete with banks and online banking platforms (e.g. the online bank in Europe called N26) that have been established more recently. The cost of upgrading big data processing hardware is enormous and recalibrating the digital platform of these financial institutions will take a lot of time and training of staff.

Companies like Google are in a perfect position to dominate the financial market in the future due to their significant flexibility and ability to respond quickly to new financial trends and customer needs. It will be interesting to see what the future holds. I do however have a concerns regarding the power and dominance firms like Google will have over such industries in the future. The rest of the banking industry will have to act fast.

Nice read!

JP Morgan are first movers among the big banks to take AI this into use – with good reason. They are currently trailing another AI programme in its Equity algorithms business called LOXM. LOXM is a programme that doesn’t tackle the question of what one should invest in, but when and how. In practice it is to execute a clients trade to the best price and maximum speed.

They say when this programme becomes “smarter” it will have the capabilities to assist in hedging and market making. Furthermore, it will get to know the preferences of its investors and learn to adapt to them.

It seems we have only just scratched the surface of AI in all types of banking – it will be interesting to see how it all plays out.

Hi Jaykishen

Very good post. I also wrote this week’s blog about banking. Whilst I agree that the appetite for AI applications has grown and so did the banks’ investment in innovation, I don’t think AI will change the face of banking in the next 3 years. AI applications will be successful in specific areas only where the data is available and the cost saving/profit making argument exist. However, due to the way banks operate (I.e. generally not interested in research endouvers) it is very hard for AI to take on a bigger role.

Hi Jaykishen,

nice post. JP Morgan has invested in 2016 over 9.5 $ billion in AI with 3 billion dedicate to new initiatives. The technology has proven successful in Equity Capital Markets and is currently being expanded to other areas including Debt Capital Markets. However I don’t think AI will change significantly the banking system in the next 3 years but I’m really excited when Blockchain an AI together can have a significant impact in the banking industry.