The Valley Might Be in a Tech’ Bubble

During his talk, Mr. Cruz briefly spoke of the flourishing ecosystem in California, especially within the Silicon Valley. He mentioned new technologies and implementations that the state of California is working on, but it seems to me that a major issue linked to that matter may impact the state: the case for a tech’ bubble.

Briefly, a tech’ bubble is an unsustainable market rise attributed to high valuations and speculation in technology stocks. One of the most significant concerns is today’s massive valuation of private companies with unsustainable burn rates.

Let’s simply have a look at some of the top unicorns based in the Valley. Uber is valued at $69 billion, Airbnb at $30 billion – which is quite similar to Marriott International’s valuation, without owning a single room. According to PitchBook, $69.1 billion was invested in 7,751 companies across the U.S. for 2016 ($6.1 billion in California solely) – one of the highest years since 2000.

“Private valuations have become disconnected from public reality,” says Jules Maltz, a general partner at Institutional Venture Partners.

Startups valuation are now based on non-conventional financial analysis, which makes it more convenient to explain their ultra high growth rates. This trend is fueled by venture capitalists looking for the next unicorn, the higher returns, the next Facebook. Some VC firms are willing to invest in startups with excessive valuations to secure financing deals. This is something we can notice in the TV Show Silicon Valley, where the company Pied Piper is offered multiple term sheets with tremendous valuation even though the company has not launched their product, highlighting some malpractices in the VC industry.

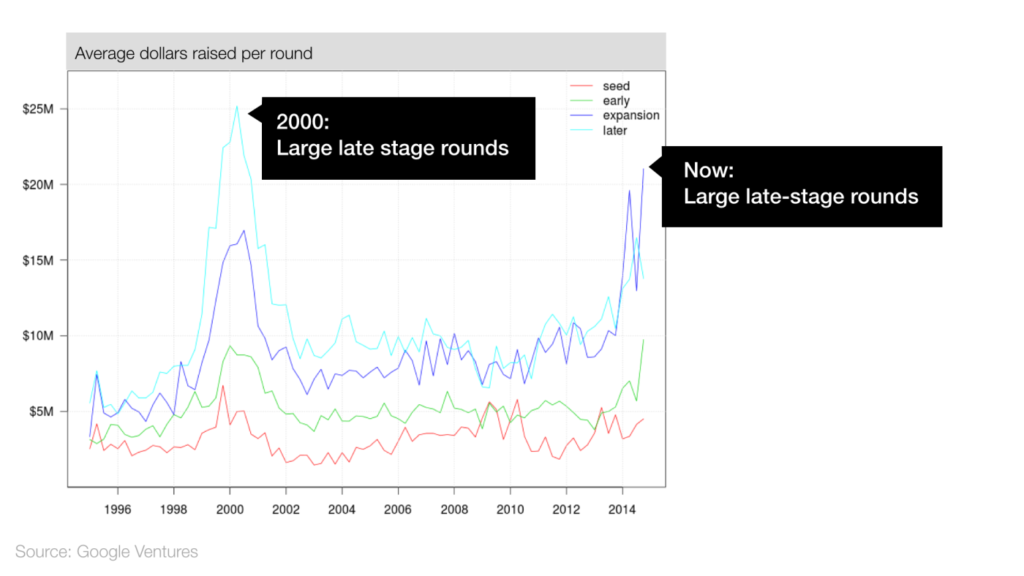

These valuations are also related to the fact tech companies are far more reluctant to go public than they were in the past. They are replaced by later-stage rounds which have grown exponentially in the last years, showing similarities with 2000 metrics as seen on the graph. « When Slack, a two-year-old startup, raised $160 million at a $2.8 billion valuation in April, its founder, Stewart Butterfield, said he did so not because he needed to but purely because he could. “This is the best time to raise money ever,” he told The New York Times. » Clearly, there is a stronger desire to remain private and raise capital through venture capital or private equity.

Sometimes it can go terribly wrong. From a $1 billion valuation to a $15 million exit in less than two years, the story of Fab.com is a terrifying illustration of excessive fundraising based on the wrong metrics. Fab’s was a flash sales site and retailer that went from scratch to $250 million in sales in 2 years. Reaching a $1 billion valuation was easy while raising a total of $310 million in funding. But Fab’s cost structure was poorly managed with a monthly burn rate of $16 million, according to TechCrunch. « If Fab had been more conservative in its numbers, more careful about its rate of spending, and had not such aggressive growth goals, it might still be around today, » said Sucharita Mulpuru, chief retail strategist at Shoptalk. With no capital left, a pivot strategy that failed to convince investors, Fab was acquired by an Irish manufacturer for $15 million in 2015. (You can find the full story here)

Either way, if there is a tech’ bubble, it will be different than the one of 2000 since most of the capital invested stays within the private sector. But it could have a bigger impact on the housing market in the Valley, decreasing prices and therefore have a pronounced impact on the state of California.

References :

https://www.bloomberg.com/features/2017-uber-airbnb-99-billion-idea/

https://www.inc.com/magazine/201509/jeff-bercovici/are-we-in-a-tech-bubble.html

https://techcrunch.com/2015/03/24/tech-bubble-maybe-maybe-not/

http://www.businessinsider.com/how-billion-dollar-startup-fab-died-2015-2

Users who have LIKED this post:

7 comments on “The Valley Might Be in a Tech’ Bubble”

Comments are closed.

I agree with the sentiment of the author that we are in an environment where the asset’s intrinsic value matters less to investors. However my take on this trend is that instead of bursting it will just slowly deflate.

Whilst Silicon Valley held the title of number 1 tech hub in the world for years, many new entrants are disrupting its current positions. Governments are turning their attention to the tech industry and are offering attractive terms for startups: Berlin, Warsaw, London etc . At the same time cost of operation and access to support and information is attracting talent to new hubs. It takes a couple of big success story to start shaping a level playing field.

This comes a critical time where the US new administration is not in good terms with its own Silicon Valley. Having said that, the current tension could be very quickly forgotten if the long promised tax breaks materialise.

But what does it all mean to valuations ? Well as supply of startups increase, price should hopefully decrease. VC will be forced to become more transparent about their results and operate less as a private clubs to compete in a more decentralised economy.

Silicon Valley house prices will not crash but developers might simply find that the grass is greener on the other side of the ocean, and decide to channel new investments there.

Hi Loic, I enjoyed your post.

Clearly bubbles in technology valuation are detrimental to the industry in the long-term, as a ‘boom or bust’ environment does not encourage consistent investment in new ideas. During so-called bubble bursts investment dries up, new innovation falters and high-growth ideas can fail to receive funding. The obvious approach is to blame VCs for investing carelessly, but I would argue there is more to that.

So where in the chain can we look to change mentality and prevent a burst? At one end of the spectrum you have the management teams who are responsible for business plans, ensuring that growth potential of their ideas is also realistic and being transparent with investors on use of funds. Overly aggressive pre-money valuations may be helpful in the short-term but not for the industry on the whole.

Investment bankers who advise them on valuation also share responsibility, especially if their fundraising fees are linked to valuation and amount of investment. Maybe they would have a different view if it was their money on the line…

VC’s are under perennial pressure to deploy capital. They compete with other VCs in finding new investment ideas and building relationships with management teams to make sure they are well positioned. After all, they have promised investors that they can find the next ‘unicorn’. VC manager incentives are linked to generating returns for their investors and if you don’t deploy capital you will never make a return! Surely the nature of their incentives can take away their discipline in choosing when to invest (and how much).

At the end of the chain it comes down to VC investors who should bear responsibility, as they desperately seek returns in a low-interest rate environment. As you note, companies are no longer keen to raise money via an IPO. Is that saying that those who invest in IPOs are the most responsible because they remain disciplined in noting that some of these companies are not worth what they seem to be, on a conventional basis?

It seems to me that more credit should be given to the discipline public markets have for curbing excessive valuations, which in the long-term can only be to the detriment of future entrepreneurs.

Users who have LIKED this comment:

Hey Loic, really liked your post. I agree that the state of Silicon Valley have the characteristics of being in a bubble and I think you highlight those in a great summary.

To add to that, I would disagree with Lana, and say that the bubble is probably going to burst, and not slowly deflate. There are plenty of reasons why Silicon Valley works like it does and one of them is because the capital is centralized and stays in the “bubble” that is the Valley. Investments are rarely made outside the Valley or the country because of legal complexity, and it’s more common that new funds are created that has capital from the Valley but they stay “outside of the bubble”. I think the Valley wouldn’t work without the resources being concentrated in the area, and investors will keep raising valuations to get to investment in the startups being founded here. The bubble will probably burst, but it will be interesting to see when!

This is such a fascinating topic! I think that most people agree that there are some “air” in the current valuations of startups and tech companies, especially in this region. There already seems to be some signs of the bubble deflating as Lana was suggesting in her comment (e.g. https://www.theguardian.com/business/2017/mar/17/startup-boom-fizzle-san-francisco-housing-investment). What I would be really interested in hearing from the ones who feel that the bubble will burst is: what do you think will trigger the burst?

Hi Loic,

I enjoyed reading your post a lot, but I cannot agree with your argument. I assert that the increasing trend at Valley is going to continue because of the following reasons: increasing investments in high-quality projects and disruptive technology.

Admittedly, Bandwagon effect has been seen in the tech industry nowadays: National Venture Capital Association reveals that venture capital funds raised a ten-year high amount of money to deploy into startups in 2016. Crunchbase also reports that the total amount of capital invested in Q1 2017 is higher than both Q3 and Q4 of 2016 by a factor of $2.7 billion and $8.3 billion respectively. However, these numbers do not necessarily lead to a tech bubble.

First of all, the average deal size is increasing while the total volume of investment stays the same. These numbers reveal an important fact: the number of deals decreases. In other words, capital flows in a more restrained way and only the real promising startups get funding. Yes, the average dollars raised per round increases, but the money goes into the startups which would really transform the raised funding into real business values. In addition, the “overprized” unicorns were created by players outside VC industry in 2015, during which excessive money flowed into the tech industry. Companies that should not survive still exist as a result. However, things change now and deal flows concentrate on real promising startups. Therefore, the increasing quality of investment would prevent from tech bubbles.

Moreover, we are in a period of fast-growing disruptive technologies, which can be seen from the increasing amount of investment in hardware. In the past decades, software has been dominant in which internet and mobile grow rapidly. In contrast, disruptive hardware technologies attract more investment nowadays; they are going to increase productivity and contribute to the economic growth.

Last but not least, the public market is rational rather than being over enthusiastic about tech companies. It can be demonstrated by the unchanged stock price of Apple after its Worldwide Developers Conference. It did not show innovation; so investors in the public market did not raise their evaluations of the company. Actually there are increasing complaints about the difficulty of fund raising this year because venture capitalists become more rational about investment. Restricted investments would contribute to a health ecosystem at Valley, in which tech bubbles is not going to be a problem in the coming decades.

Users who have LIKED this comment:

Hey Loic, thanks for sharing your views. It’s definitely a hotly debated and sensitive topic. There have been talks of bubbles in many other markets these days (housing, Bitcoin, Art, etc.) The key issue for me is, what do you think are the catalyst that could cause the bubble to pop? What would potentially cause investors to pull out of the valley? My opinion is simple, the companies that are solving real problems and providing a real benefit to their users will continue to grow and have access to capital. Scrutiny of start-ups will undoubtedly increase as we mature in the cycle and that’s a good thing. Its difficult to conclude that blow ups like Fab.com will be the tipping point.

Hey Johnny,

It’s tough to tell, and honestly, I am not convinced that the bubble will pop but rather deflate slowly (as Lana mentioned above). Investors will stay in the Valley since we’re in an era of massive technological disruption (Blockchain, AI, VR/AR, etc.) that will push investors to stay where most “things” happen. But this rush for the next unicorn is pushing some investors to adopt strange behaviors regarding due diligence. Therefore, it drives other startups to increase their burn rates and not focusing enough on profitability and sustainability for instance (the case of Fab) since they still receive funding.