The “Acquihire” Phenomenon: The use of M&A as a HR strategy

New form of acquisition

With the advent of artificial intelligence, Internet of things, big data and cloud, attracting top-level engineers has become one of the most important factors to compete in those lucrative emerging sectors. Top tech companies, such as Google, Facebook, or Cisco has recently started acquiring startups, not necessary for their product or service, but for their talents. This phenomenon is called “acquihire”, which is a combined work of “acquisition” and “hire”.

This topic is based on the public forum hosted by Stanford Silicon Valley – New Japan Project, a co-production of the Shorenstein Asia-Pacific Research Center Japan Program and US-Asia Technology Mangement Center at Stanford University. What makes this topic interesting is that “acquihire” phenomenon is still so new that there is a very limited number of research.

How the merger process works

The acquisition process is quite similar to a normal M&A. However, some of the unique terms for acquihire is the following:

- Startups’ original product will no longer exist

- Some cash for debt (investors and other liabilities) is to be paid to acquire

- Acquiree’s employees will receive cash bonus and stocks that vest over a 3-6 period

- Acquiree is most likely given autonomy to their specific project (i.e. keep their team and do not have to culture fit into acquiree)

From investors’ perspective, they will get paid back almost the same (plus real inflation rate) amount they invested. Hence, a normal M&A is much better for VCs, because they receive capital gains. As for acquiree’s employees, they are given a great amount of cash with “golden cuffs”, stocks that vest over a 3-6 period, so they are highly motivated to stay in the company and the length of “golden cuffs” is determined by the project there are assigned to. This financial incentive structure is well designed to keep the acquiree’s employees in the company. Some of the issues associated with M&A is cultural differences, but in this acquihire case, it does not become a problem, because acquiree is not forced to adapt to acquirer’s culture. For example, if you are acquired by Alphabet, you don’t necessarily have to be Googlers, which reduces the risk of M&A.

Acquihires still limited to big players

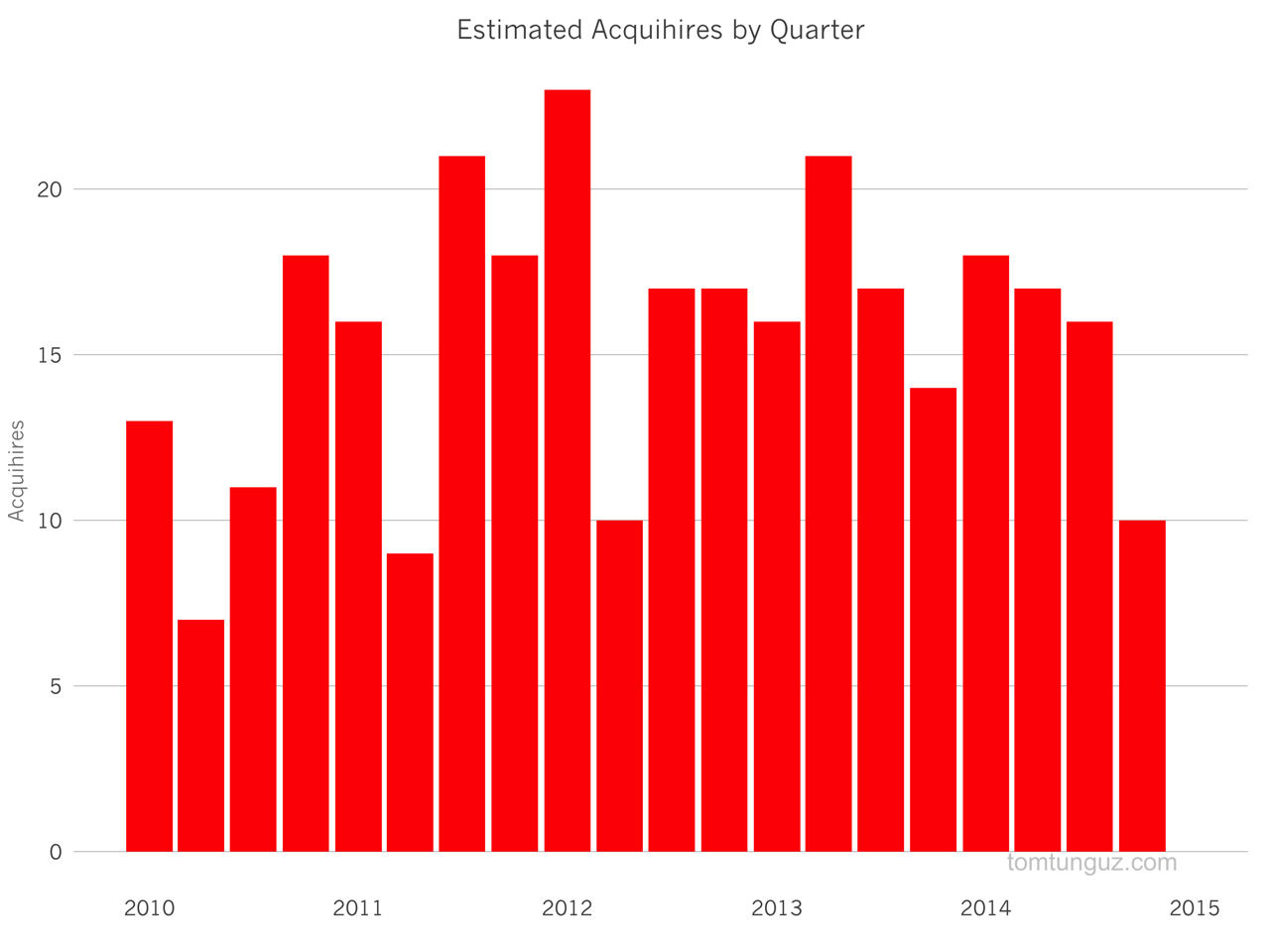

Below is an estimated acquihire by quarter.

Source: http://tomtunguz.com/startup-acquihire-trends/

The number of annual acquihires has not changed dramatically over the period. Partly because a limited player (i.e. Facebook, Yahoo, Google, and Cisco) takes this initiative and it is still far from being prevalent.

Who gets acquihire

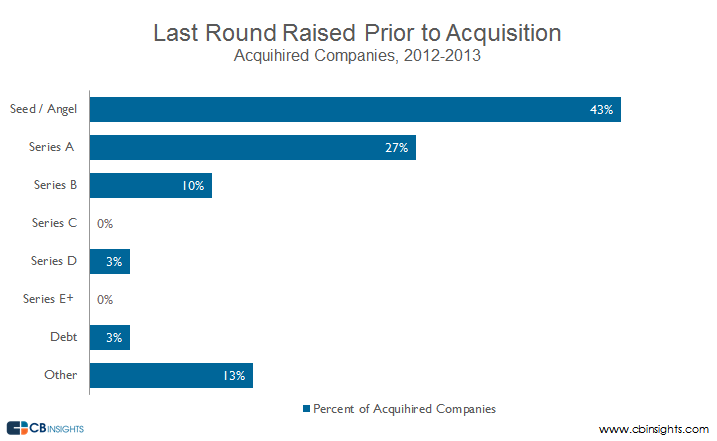

As shown below, a majority of acquihired startups are in a Seed/Angel stage.

Source: https://www.cbinsights.com/research/tech-acquihire-report/

Apart from a huge paycheck and “golden cuffs”, this is another reason why acquihire makes sense to startups. I had an initial impression that serial entrepreneurs would not easily dump their business, but I came to realized that most of startups who get acquihired is struggling in funding, which makes perfect sense to exit early and secure financial benefit.

So, do you want to get acquihired? If you do, I believe it’s important to understand what big tech players are trying to in the future and what skillsets are needed to accomplish. If you can spot those niche areas and skillsets, who knows in the future, you might get acquihired.

One comment on “The “Acquihire” Phenomenon: The use of M&A as a HR strategy”

Comments are closed.

Hey Will, thanks for the post…acquiring start-ups for talent has definitely been standard practice for many years now in silicon valley. Its very interesting to look through Google’s yearly M&A activity, the majority of their deals don’t even make headlines and are arguably for acquiring talent. What I find interesting with regards to acquihiring is that in a lot of cases the founder ends up leaving the firm but his team stays intact. I think founders in general have a harder time adapting to larger corporations but in many cases their team fits quite well.

What I also find interesting is the fact that acquihiring happens in many other industries, particularly in industries that are asset light or capital light. For example, in finance, it was standard practice in the pre-2007 era for banks to acquire talented hedge fund managers and their teams to run prop trading desks at their firms. The former CEO of Citibank Vikram Pandit was actually acquihired from a hedge found he started. We see this happening a lot for not only a persons talents or skills, but also their relationships. Brokerages and firms that have strong ties to local markets could also be considered acquihires as these are ways for foreign players to enter new markets in an effective way.

Cheers,

Johnny