Silicon Valley: the NIMBYland

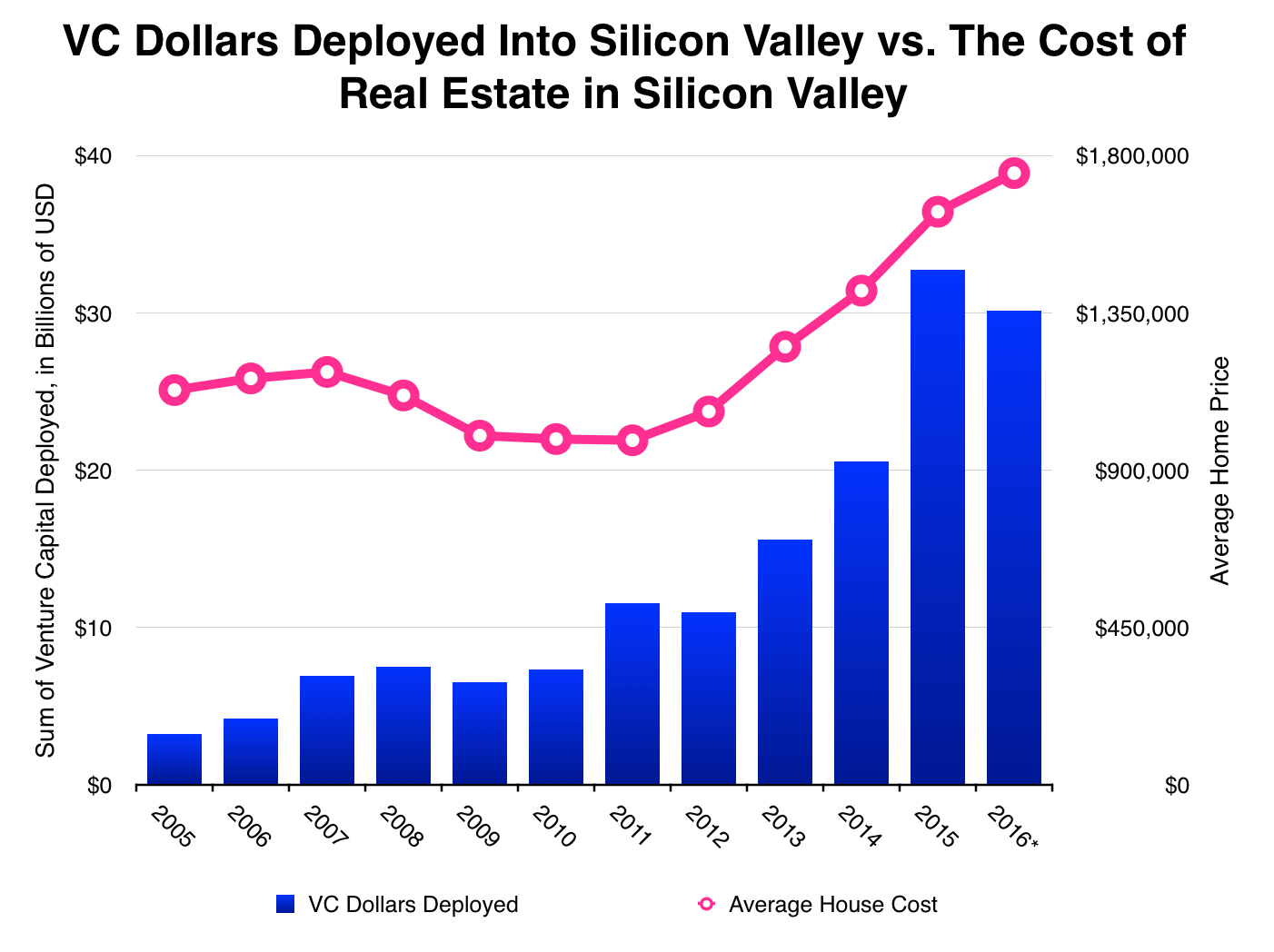

It is a well-known fact that, much like the treacherous waters surrounding Alcatraz Island, the housing market in the Bay area is a cold and unforgiving place to be if one doesn’t have the means to stay afloat. The price of housing has been increasing steadily over the last few decades, following the boom of investments in the numerous IT companies of the Silicon Valley, only plateauing for a few years during the worst of the Great Recession; this stop didn’t last for long though, and prices kept growing at their usual rate and have continued to do so ever since.

As in (almost) every other situation, this phenomenon determined winners and losers: the winners are obviously the people that already owned plots of buildable land in the Bay Area; they are now much better off since the average land value greatly increased. We can call these persons the NIMBY (Not In My BackYard) group: they have all the advantages to keep the price of housing high, since they directly profit from it (or have in general a very high sunken cost in the housing market if they bought recently, and they fear their very expensive investment may decrease in value if new houses were to be built).

The NIMBY group makes for a very inelastic supply of housing on the market; in San Francisco, this group opposes the construction of high-rises building, which would in some way alleviate the upward pressure on housing prices in the Bay, citing issues like the danger of focusing on building only high-end housing and a decrease in the housing quality of the building surroundings high-rise apartments (due for example to the large shadow this kind of buildings can cast on the neighbouring settlements) [1].

This, to be fair, is a legitimate concern: there’s obviously an interest for the constructors and owners of these new high-rise buildings to allocate most of the habitable space to high-end apartments and office complexes, which have a much higher yield than apartments for low-income persons; this would not solve the housing problem, since luxury apartments would only increase the average rent prices in the city, further pushing lower and middle-income classes out of the city (this is my hypothesis, at least. Can gentrified neighborhoods become more gentrified, or would more expensive options push down the price of the former top choice, as it happened with first-class flights? I think this topic would make for an interesting discussion).

Who are the losers in this situation? As one could expect, the YIMBY (Yes In My BackYard, or maybe Just Give Us A BackYard) group is mostly composed of middle-lower income families and young professionals trying to work in the Bay. More surprisingly, one of the losers in this situation are the IT companies that by their mere presence in the Silicon Valley drive up the price of housing.

The reason is very simple: as the prices of rent continue to increase, the same thing must happen accordingly to the salary of the average IT worker, or otherwise, the Silicon Valley may lose its attractiveness to other innovation hotspots where comparative salaries are higher. In an already competitive environment, salary bumps due to increasing rent costs are, I believe, a danger to the economic well-being of IT firms.

The main advantages of concentrating multiple companies of a related field in the same restricted area are related to agglomeration; in the Silicon Valley, this generates a large supply of specialized labor and a very useful phenomenon called “spillover” (when workers change company frequently, spreading new ideas in the market). One of the disadvantages of agglomeration is that it increases land prices (as we’ve seen already) but also reduces the firms’ pricing power (it becomes difficult for a company to apply pressure on an experienced worker, because if he were to be fired or leave the firm he would have multiple choices of employers). The decrease in the firms’ pricing power forces them to further increase the average salary to keep a hold on their most valuable employees, putting an additional strain on their budgets.

Now, it is true that most IT companies of the Silicon Valley have made incredibly high profits in the last years [2], and they can well afford to pay their employees a bit more, but this “first comer advantage” may not last forever, and in any case it makes it difficult for small startups to access the labour market in the area, which could cause a loss in innovation.

I believe that if this process continues the advantages of agglomeration may be outweighed by its costs, pushing down costs and salaries until a new equilibrium is reestablished. However, as in many cases, IT could offer us a solution from a problem it created:

“As technology evolved, companies such as IBM found they could eliminate permanent offices for sales reps and other customer-facing employees. Such moves yielded huge cost savings on real estate [emphasis added] while increasing the time reps could spend with customers. Now, thanks to broadband, cloud computing, and a burgeoning market for online collaboration tools, many more jobs that once required in-person interactions can be performed anywhere. […] In fact, by some estimates perhaps one-quarter of all US jobs could be performed remotely, and in our 2011 survey of 2,000 US businesses, one-quarter of them said they planned to use more remote workers in the future.”[3]

Thanks to the Internet, firms focused on services and other non-physical sectors can take advantage of the “global village” to acquire the experts they need without resorting to an increasingly expensive agglomeration.

Sources:

[1]: www.bizjournals.com/sanfrancisco/blog/2013/07/nimbys-are-back-sf-builders-face.html

[2]: www.cnbc.com/2018/01/21/ten-largest-us-tech-firms-2018-revenue-seen-topping-1-trillion.html

[3]: www.mckinsey.com/business-functions/organization/our-insights/preparing-for-a-new-era-of-work

Users who have LIKED this post:

One comment on “Silicon Valley: the NIMBYland”

Comments are closed.

Wow! Very interesting read. Outsourcing labour outside of silicon valley is an approach many conglomerates use to cut down costs. City limits on housing also contributes to why real estate is so expensive here. Cool graphics as well! Very informative.

Users who have LIKED this comment: